- 2024-04-19

- 阅读量:4710

- 来源|Cosmetic Business Online

- 作者|Zhu Cong

The first local cosmetics company changed hands.

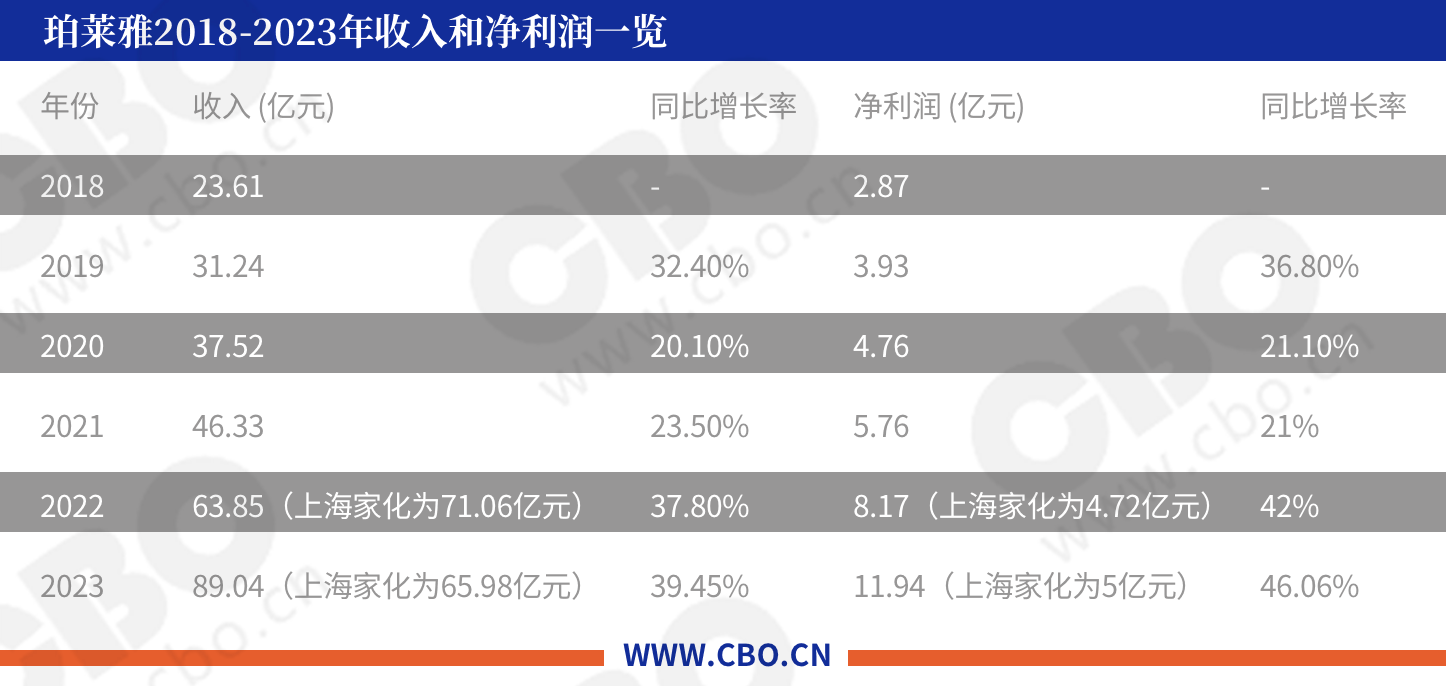

On the evening of April 18, PROYA Cosmetics Corporation (hereinafter: PROYA) released its FY2023 earnings report as well as its Q1 2024 financial results.According to the data, PROYA 2023 operating income of about 8.905 billion yuan, an increase of 39.45% year-on-year; net profit attributable to shareholders of listed companies of about 1.194 billion yuan, an increase of 46.06% year-on-year; and basic earnings per share of 3.01 yuan, an increase of 45.41% year-on-year, sitting on the throne of the first local beauty companies in the size of the annual revenues.

Meanwhile, PROYA welcomed another exciting start in the just-passed 2024 first quarter, with operating revenue of 2.182 billion yuan, a year-on-year increase of 34.6%, and net profit of 303 million yuan, a year-on-year increase of 45.6%.

It is worth noting that over the past six years since listing, PROYA's compound annual growth rate has been 35%, and the compound growth in the last three years has been more than 42%, which is accelerating.

Compared with the international giants, the scale of domestic cosmetic enterprises is still very small, and the global top ten threshold in 2022 is 30 billion yuan +. PROYA's revenue in 2023 was nearly 9 billion, and it should be able to break through 10 billion for the first time in 2024, but there is still a 3-fold gap from the world's tenth.

Earnings data shows that online remains PROYA's main battlefield.

In FY2023, the Group's online revenue accounted for 93.07%, and the growth in revenue from main business was mainly due to revenue from online channels of RMB8,274 million, an increase of RMB2,486 million, or 42.96%, year-on-year.

The main brand PROYA reached another record high in 2023 with revenues of $7.177 billion, an increase of 36.36% year-on-year, while the Caitang brand's revenues reached $1.001 billion in 2023, an increase of 75.06% year-on-year.

● Intercepted from PROYA's financial report

In FY2023, the turnover of PROYA Tmall flagship store was ranked No. 2 in Tmall beauty and No. 1 in national products; during the Double 11 campaign, the turnover of PROYA Tmall flagship store was ranked No. 1 in Tmall beauty, bucking the trend.In FY2023, the turnover of PROYA brand was ranked No. 3 in DouYin beauty and No. 2 in national products; during the Double 11 campaign, the turnover of PROYA brand was ranked No. 1 by DouYin Beauty.

At the Group level, the share of revenue from the main brands is continuing to decline, indicating that new brands are being developed and that the Group's strategy is off to a good start.

The aggressive marketing strategy adopted by the company is behind the sales growth.

PROYA invested massively in marketing activities in 2023, with selling expenses amounting to $3,972 million in FY2023, compared to $2,786 million in FY2022, an increase of $1,186 million, or a growth rate of 42.59%. Image publicity and promotion expenses amounted to $3.534 billion, accounting for the majority of the selling expenses.

R&D expenses for the period were $174 million, or 1.95% of operating income.

PROYA pointed out that during the past year, the company has invested and practiced in environmental protection, public welfare donations and poverty alleviation; and has made progress in its "6*N" strategy, i.e., it has promoted multi-brand development through innovations in six areas, such as new consumption, new marketing and new organization.