- 2020-12-25

- 阅读量:2268

- 来源|CBO

- 作者|Zhang Huiyuan, Zhu Cong

The originator of the "facial cleansing device" failed to live past 20 years old.

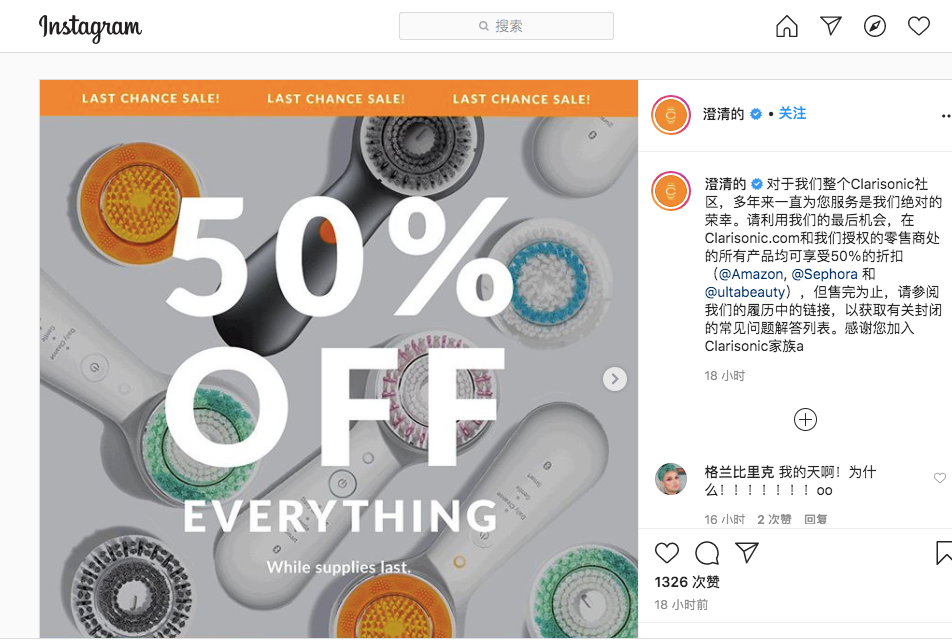

On July 15, 2020, Clarisonic, a beauty instrument brand under L'Oréal, announced on its official website and official Instagram account that “after more than a decade of game-changing innovation and industry-leading technology”, the brand will be shutting down on September 30, 2020. All products will be sold at a 50% discount on our official website of Clarisonic, as well as our authorized sales channels such as Sephora, Amazon, ultabeauty, while supplies last.

△ Clarisonic’s official Instagram account announced that the brand will be shutting down, with a 50% off everything

Many followers expressed their shock on Clarisonic’s official Instagram account, with comments like “no!” that could be found in the comments section.

△ The followers left sad messages on Clarisonic’s official Instagram account

From September 30 onwards, Clarisonic will no longer sell its devices, brush heads and accessories but consumers can continue to purchase Clarisonic products at its authorized retailers, which will be subject to the final supply. In addition, for personal privacy issues about which consumers are more concerned, L'Oréal stated it also provides account deleting service.

Regarding the reasons for the brand closing, Clarisonic stated on its official website "This difficult decision was made so that L'Oréal can focus its attention on its other core business offerings."

In Clarisonic’s flagship store on Tmall in China, the reporter found that the full line of products in the store has begun to be sold at a discount from today. The activity will end on July 25. The eye V-face lifting and tightening instrument has dropped to 1,499 yuan from the original 2,449 yuan, representing the greatest plunge in prices.

CBO exclusively verified the above news with L'Oréal China. "In recent years, with the continuous evolvement of the beauty instrument market, competition has been heating up. To strengthen the brand in our product portfolio that only focuses on the beauty instrument market segment entails huge investment. In spite of always belief in that 'beauty enhancement' is the key to future success, we hope to focus on our core business offerings and develop possible devices within L’Oréal’s existing brand portfolio in the current context," stated L'Oréal China.

Affiliated to the high-end cosmetics department, and as the only beauty instrument line under the L'Oréal Group, how did Clarisonic come to this day?

01

The loss is greater than that of MG

The originator of "facial cleansing device" failed to live past 20 years old

"We want to thank all of our loyal consumers, dermatologists, and retail partners who have helped put this brand on the map. It has been our absolute honor to serve you all these years," said Clarisonic in its closure announcement with sadness.

According to public information, Clarisonic, which was founded in the United States in 2001, is the "originator" of the facial cleansing device, which was the first to expand the sonic technology to the personal care space.

The "black technology" principle of the Clarisonic facial cleansing device uses high-frequency oscillating vibration technology to deeply cleanse the skin. When in use, the machine oscillates at a frequency of about 300 times per second, with the cleansing effect 6 times that of ordinary hand-washing facial cleansing. After use, the skin absorption rate of skincare products will increase by 61%. To this end, the brand has applied for more than 40 patents for the sonic technology.

In 2007, Oprah Winfrey, hailed as the Queen of American talk shows, "hand-picked" the Clarisonic facial cleansing device as her favorite item of the year, making it a hit. In 2011 the Clarisonic facial cleansing device became a must-have item recommended by a number of internet celebrities and mainstream magazines in the United States. In 2012, Clarisonic was acquired by L'Oréal and was incorporated into the high-end cosmetics department.

In the following year after being acquired by L'Oréal, the Clarisonic brand officially entered China, and Sephora became its general distributor in China. In the same period, FOREO, a Swedish beauty instrument brand, also barged into the Chinese market.

Since Clarisonic and FOREO were the first facial cleansing device brands to enter China, they are also generally regarded by consumers as the enlightened brands in the facial cleansing device market in China, which are also known as "magic tools for facial cleansing".

In 2014, Clarisonic opened its makeup counters in the department store. In October 2015, Clarisonic officially settled in TMall. On the day of Double Eleven, 3 units were sold per minute, on average, on the platform.

△ Clarisonic is part of L'Oréal’s luxury cosmetics division

Looking back now, 2015 marked a year when Clarisonic's brand recognition was being fully established in China, and 2017 was the year of the brand’s explosive growth. With right time and place, Clarisonic, after two years of market cultivation, achieved a surge in performance far beyond expectations in the Chinese market in 2017, among which 70% of its sales were from online and the annual sales volume of several star products such as the Mia2 family reached over 40,000 units.

In October 2017, Zheng Liang, the then Brand Director of Clarisonic China, revealed in an exclusive interview with CBO that Clarisonic was in a leading position in the market share and ranked first in the facial cleansing device category.

The public opinion at the time held that under the umbrella of L'Oréal as a beauty makeup giant, Clarisonic could deeply connect beauty instruments and cosmetics, and effectively promote the subsequent joint sales of skincare and makeup brands; at the same time, Clarisonic’s high reputation and high market share as well as unique sonic technology in the facial cleansing spectrum were in turn helpful to consolidating the technological image of L'Oréal as a leading beauty group.

However, the rise of the beauty instrument market in China has not helped to save Clarisonic from failure in the global market.

In July 2016, in the 2016 interim results announced by L'Oréal, Clarisonic recorded an impairment loss of 234 million euros in the first half of the fiscal year, while MG which was considered as a “Waterloo” event for L'Oréal’s acquisition reported a loss of 213 million euros in the same period, slightly better than Clarisonic.

At that time, some European and American commentators analyzed that because the brand's profit has long been mainly dependent on the repetitive buying of new brushes, it has been unable to find a better profit Model. At the same time, in the relatively mature European and American facial cleansing device markets, Clarisonic was caught in the crisis prematurely. In addition, many European and American dermatologists said that more and more patients were over-cleansing the skin as a result of the use of Clarisonic.

02

Conjectures about the reasons for Clarisonic's failure

Poor profitability, single product line, hidden dangers of over-cleansing

According to the "2016 China Import Consumption Insight Report" released by CBNData, from 2014 to 2016 the sales of electronic beauty instruments on Tmall had a blazing-fast increase. From the data increasing trend between January 2016 and October 2017 from Baidu Index, it can be seen that the search index of the beauty instrument on PC and mobile terminal skyrocketed from July to September 2016. This high level of attention became normal after 2017, and came to its peak within seven years in September 2017.

What are the factors hindering the development of Clarisonic in China?

First of all, due to the primary attributes of the cleansing category, Chinese consumers seem to be particularly sensitive to the price of facial cleansing devices compared to household beauty instruments such as introduction devices, lifting and tightening devices, hydrating devices, and hair removal devices.

Although Zheng Liang from Clarisonic revealed in 2017 that the brand would gradually expand from cleansing to beauty (skincare, makeup), the reporter searched for its flagship store on Tmall and found that the brand only sells V-face lifting devices, men's cleansing devices, supporting cleansing gels and several other SKUs currently, still mainly focusing on facial cleansing devices, with the prices ranging from 989-2449 yuan RMB.

But when searching for "facial cleansing device" on Taobao, the mainstream online shopping platform, the CBO reporter found that the best-selling facial cleansing device was a domestic brand from Jinhua, Zhejiang Province. It has so far sold over 55,000 units for 19.9 yuan RMB. The unit prices of Top2 and Top3 products are all below 40 yuan RMB. The top 3 by sales alone have absorbed nearly 130,000 consumers.

Second, as consumers have been increasingly going pro in skin care in recent years, the issue of "over-cleansing" resulting from facial cleansing devices has attracted public attention. According to a survey data released at the 12th "National Skin Care Day" event, 48% of the 2 million outpatients in dermatology clinics suffered allergic skin diseases, of which 10% were caused by "over-cleansing".

In the reports on "over-cleansing", a number of dermatologists suggested that the facial cleansing device should be used in a normative manner, and provided scientific guidance on the materials, frequency of use, and efficacy of the facial cleansing device. When searching Xiaohongshu and other platforms, the reporter found there were many comments about the skin barrier being damaged by the facial cleansing device, with a large number of threads.

What’s more, facial cleansing is an extremely basic and highly replaceable item, which is prone to being replaced by medical beauty. Whether it is a new type of skin care institution or the intervention of the traditional CS channel in medical beauty, cleansing programs with short time and quick results are all very popular.

The reporter browsed through facial cleansing group buying programs such as popular “small bubble” and “oxygen jet" on Dianping, Meituan and other platforms and noted the prices ranged from tens to hundreds of yuan. The most popular beauty agency can sell over 10,000 facial cleansing programs in the form of group buying per month.

Lastly, compared with other cleansing beauty instruments, Clarisonic products are also roasted by consumers with such complaints as "too troublesome to replace the brush head", "too large to carry" and others. On Black Cat, a consumer service platform owned by Sina, the reporter found many complaints about quality problems such as "failure to be activated after replacing the brush head" and "unable to charge".

03

The new generation replaces the old

The domestic beauty instrument market worth tens of billions of yuan will continue to expand

Does Clarisonic's failure herald that the household beauty instrument market is steadily losing ground?

In fact, on the contrary, in the Chinese market alone the household beauty instrument domain remains a blue ocean. According to statistics from ECdataway, the online sales of electronic beauty instruments in China are still growing, and the sales scale in 2020 will be 3.6 times that of 2018. Some insiders predict that the market for household beauty instruments is likely to exceed 20 billion yuan in 2020.

After the pandemic, "at-home spa" has become a new trend, and the "Beauty Economy" and "Stay-at-Home Economy" have stimulated the warm-spring consumption. According to data from taosj.com, the sales of electronic beauty instruments went up by 152% year-on-year in Q1 2020.

In Q1 2020, the brands YA-MAN, ROBLL, and QUCOTO were among the top three in terms of sales in the industry. YA-MAN ranked first in its category with sales of over 200 million yuan. Cleansing pores, introducing essence, and lifting and tightening are the introductory requirements for consumers to purchase beauty instruments, while tightening and reducing wrinkles, moisturizing and brightening, and improving skin power are the advanced demands of consumers who are willing to pay more.

As a range of imported players such as YA-MAN, Hitachi, REFA, Tripollar and FOREO have gained a foothold in China, local Chinese brands such as K·SKIN, COSBEAUTY, and MUSHU have risen with internet marketing, and even home appliance giants like Haier have also entered the game.

As the "hero" who introduced Clarisonic to China, Chen Min, Vice President and Head of the Active Cosmetics Division at L'Oréal China, pioneered the business model of the combination of beauty instruments with skin care products before the domestic beauty instrument was brought to the forefront.

It is perhaps not a pity that it has lost the facial cleansing instrument sector for L'Oreal. How to adapt to consumers' demand for higher efficacy and higher technical content is a key and urgent issue. As L'Oréal said in its reply to CBO, “Our Group always believes that 'beauty enhancement' is the key to future success.”

Supporting its brand pool and expanding the skin care and makeup lines may be no less a priority of L'Oréal in the future. The reporter found that having possibly absorbed the experience of combining beauty and instruments, L'Oréal has continuously developed supporting beauty instruments among its beauty brands in recent years. For example, Lancôme once launched a lifting roller massage stick face-lifting beauty device, and L'Oreal once launched a special triple elastic ice massage beads that come with enzyme eye essence, and L’Oreal even released the Perso Smart Skincare system – a portable skin care beauty instrument – at CES 2020.

Therefore, shutting down Clarisonic may not necessarily mean that L'Oréal has to stay away from the beauty instrument category, and it is not difficult for L'Oréal to integrate Clarisonic's products and technologies into its flagship skin care brand. While the household beauty instrument market worth tens of billions of yuan is still expanding, L'Oréal will focus all its attention on the main track of beauty makeup.