- 2022-02-09

- 阅读量:4308

- 来源| Cosmetic Business Online

- 作者|

The COVID-19 pandemic that broke out in early 2020 was a devastating blow to the domestic economy. Under this background, the domestic business environment has been harsh. In the past two years, most industries have been having sluggish market growth. In late 2021, the cosmetics industry became the first to break through the predicament, with the annual retail sales exceeding RMB400 billion for the first time in history.

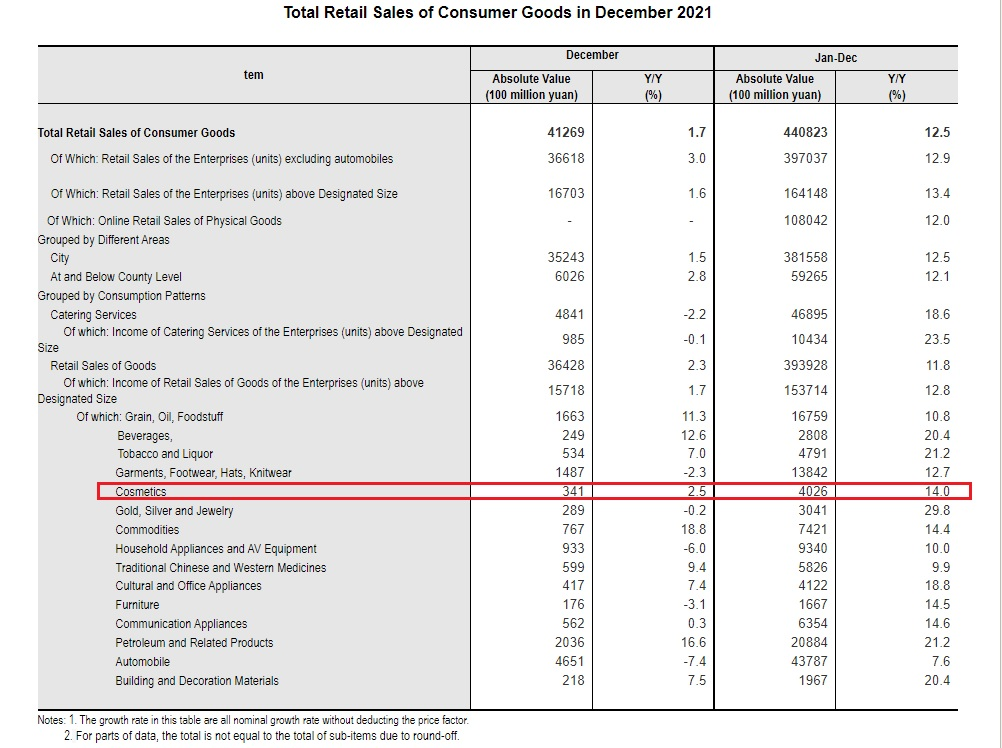

anuary 17, the National Bureau of Statistics announced that the total retail sales of consumer goods in 2021 was RMB44,082.3 billion, up 12.5% over the previous year, with a two-year average growth rate of 3.9%. Specifically, in December 2021, the total retail sales of consumer goods were RMB4,126.9 billion, a year over year increase of 1.7%.

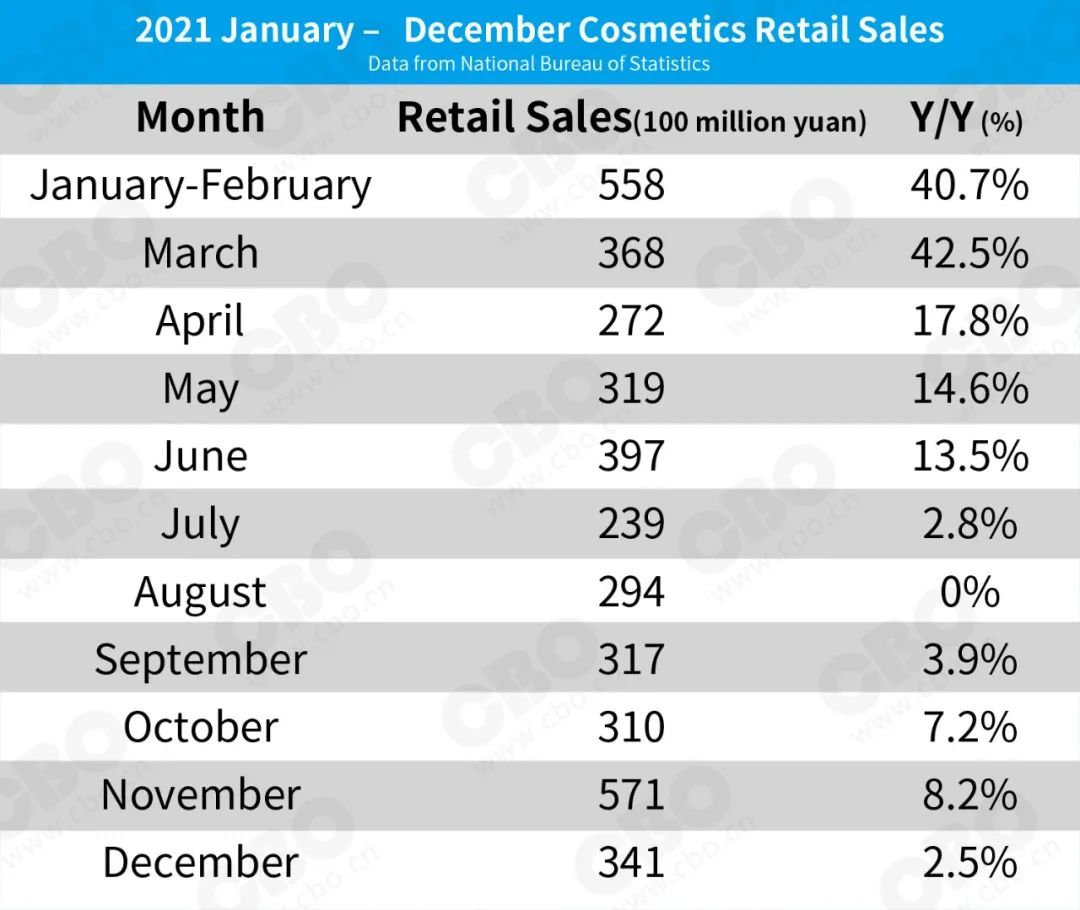

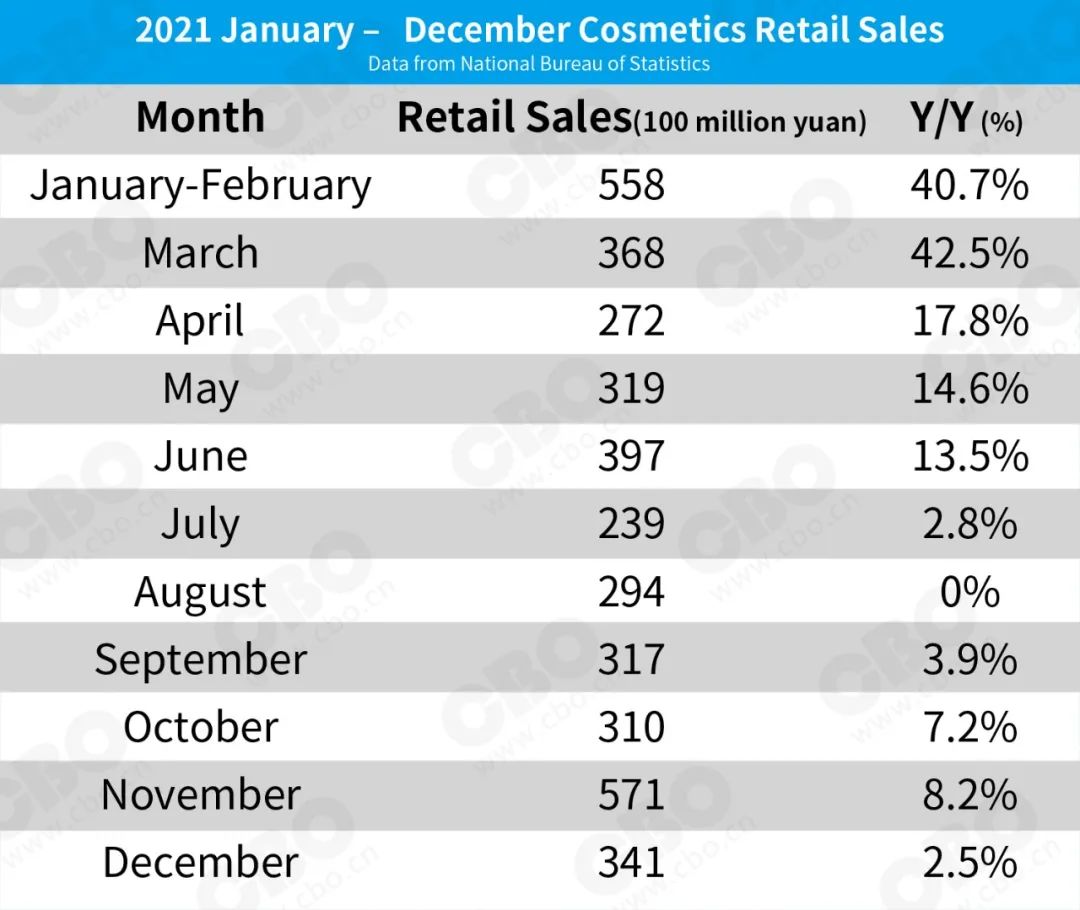

In the category of cosmetics, the total retail sales from January to December 2021 were RMB402.6 billion, a year over year increase of 14.0%. Specifically, the retail sales in December was RMB34.1 billion, a year over year increase of 2.5%. Despite the slowdown in the growth of cosmetics retail sales since the second half of last year, the annual growth rate overall still exceeds 14.0%, exceeding the growth rate of 12% of the total retail sales. It is worth mentioning that cosmetics sales have exceeded RMB400 billion for the first time in history.

In the past three years, the retail sales of cosmetics in China have steadily increased, reaching RMB299.2 billion in 2019, RMB340 billion in 2020 and RMB402.6 billion in 2021. According to the forecast by data analysis company FORWARD (qianzhan.com.cn) , the total retail sales of cosmetics in China is expected to reach RMB500 billion in 2025. The vast market will surely provide a golden opportunity for beauty brands.

The CBO reporter noticed that among the 18 categories classified by the National Bureau of Statistics, the cosmetics category grew 14.0% in 2021, ranking ninth. In fact, since the second half of 2021, the monthly growth of cosmetics retail sales has not exceeded double digits. Except for the zero growth in August, the growth rate of 2.5% in December ranked second to last. In the fourth quarter of 2021, the monthly growth rates of cosmetics sales were 7.2%, 8.2% and 2.5% respectively, with obvious month-on-month decreases.

In terms of online retail, the online retail sales in 2021 were RMB13,088.4 billion, up 14.1% over the previous year. Specifically, the online retail sales of physical goods were RMB10,804.2 billion, an increase of 12.0%, accounting for 24.5% of the total retail sales of consumer goods. In the online retail sales of physical goods, the goods for food, clothing and daily commodities increased 17.8%, 8.3% and 12.5% respectively. The high online growth tends to attract more brands to focus more online.

According to the data released by Tao Technology, in 2021, the online GMV of makeup and skin care totaled RMB255.45 billion, down 7.0% year over year. Specifically, in December, the online GMV of makeup and skin care totaled RMB17.156 billion. Among them, the online GMV of skin care was RMB 11.440 billion, down 24.91%, and the online GMV of makeup was RMB5.716 billion, down 22.92%.

In terms of international brands, according to the data released by Tao Technology, in 2021, the three international leading brands Lancome, Estee Lauder and L 'Oreal all maintained double-digit high growth in the first half of the year, with negative single-digit growth in the second half of the year, and with annual growth rates of 6.2%, 14.5% and 9.2%, respectively. Shiseido maintained positive growth in all four quarters, with an annual growth rate of 38.8%. OLAY witnessed relatively stable performance, with an annual growth rate of 2.8%. SK-II performed relatively weaker in the whole year, and its growth rate turned negative since the second quarter, resulting in an 8.8% drop in its the annual growth rate.

At the same time, the growth rates of domestic brands were clearly differentiated. Winona, Proya, Timage and QuadHA all realized high-digit growth in GMV in 2021. Specifically, the GMV of Winona and Proya increased 70.3% and 54.6%, to RMB3.204 billion and RMB2.147 billion respectively, and exceeding RMB 3 billion and RMB 2 billion respectively. QuadHA’s GMV grew rapidly, hitting 154.1%. The annual growth rates of Jahwa's Dr. Yu and Herborist and Bloomage's BIOHYALUX and MedRepair were 11.1%, 14.6%, 35.1% and 15.9% respectively. The growth rates of Florasis, Perfect Diary, UNIFON and MARUBI dropped by various degrees.