- 2021-10-28

- 阅读量:2224

- 来源|Cosmetic Business Online

- 作者|Zhang Zhao

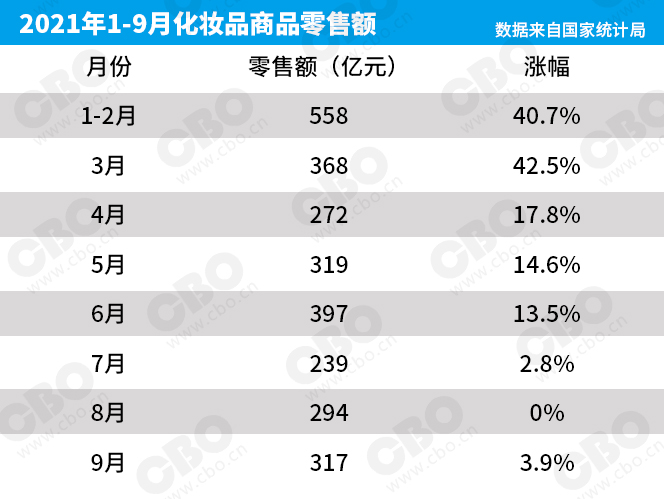

After two consecutive slow season months of sluggish growth or even zero growth in July and August, the cosmetics sales market started to show signs of slight recovery in September. In September the total sales of cosmetics amounted to 31.7 billion yuan, a year over year increase of 3.9%, which meant that the growth remained sluggish.

According to the data released today (October 18) by the National Bureau of Statistics, from January to September the total retail sales of social consumer goods amounted to 31,805.7 billion yuan, a year over year increase of 16.4% and an increase of 8.0% compared with January-September in 2019. Specifically, in Septemberthe total retail sales of social consumer goods amounted to 3,683.3 billion yuan, a year over year increase of 4.4% and an increase of 7.8% compared with September 2019, with an average two-year growth rate of 3.8% in two years.

Among the 18 Income of Retail Sales of Goods of the Enterprise (units) above Designated Size categories, the top three categories in terms of retail sales growth rate are Communication Appliances, Cultural and Office Appliances and gold, silver and jewelry, with year over year increases of 22.8%, 22.6% and 20.1% respectively, all above 20 percentage points, which are higher than those in August. Cosmetics ranked fourth from the bottom, down one place from last month, and the growth rate was only higher than Garments, Footwear, Hats, Knitwear, Commodities, and Garments, Footwear, Hats, Knitwear, Commodities.

The total retail sales of cosmetics from January to September amounted to 278.3 billion yuan, up 17.9% year over year, of which the retail sales of cosmetics in September was 31.7 billion yuan, a year over year increase of 3.9%. Since July, the growth of the total retail sales of cosmetics has been slowing down, with an increase of 2.8% in July and a rare 0% in August. In and a rare the growth rate went up slightly, reaching 3.9%, but the growth remained sluggish.

As for the online channel, from January to August 2021 the national online retail sales reached 8,122.7 billion yuan, a year over year increase of 19.7%. Specifically, the online retail sales of physical goods reached 6,634 billion yuan, an increase of 15.9%, accounting for 23.6% of the total retail sales of social consumer goods. In the online retail sales of physical goods, food, clothing and consumer goods increased 22.4%, 19.4% and 14.2% respectively.

In fact, the market downturn in July and August was mainly due to the repeated occurrence of the COVID-19 epidemic in a number of cities, which had a great impact on the consumer market. With the epidemic situation brought under control, the market sales increased substantially. However, with the overall recovery of market performance, the online cosmetics sales in September were still not ideal. According to the data of Taobao series, the total GMV of Taobao series' make-up and skin care in September was 16.2 billion yuan, a year over year decrease of 28%. Specifically, skin care GMV was 11.6 billion yuan, a year over year decrease of 18%, while makeup GMV was 4.6 billion yuan, a year over year decrease of 44%.

In terms of brand, according to the data of Taobao series due to the low base factor the GMV of the foreign brand Lancome increased 370% year over year in September, while the GMVs of the makeup brands Shu Uemura, Bobbi Brown and NARS increased 40%, 10% and 26% year over year respectively in September, which meant that the growth slowed down slightly.

Overall, in September, in terms of sales performance, domestic cosmetics brands on Taobao-series platforms varied and were slightly better than international brands. Among them, Proya's performance was the most eye-catching, with sales in September being 53.45% year over year. Shanghai Jahwa's brands Herborist and Dr. Yu maintained the growth trend in August, with sales being 28.37% and 41.69% year over year respectively, showing that their brand power and product power were further verified. The sales of Winona, a brand under Botanee, were 1.3% year over year, showing that the growth rate slowed down significantly. Unifon continued its negative growth trend, with a year over year decline of 60.28%, mainly due to the company's efforts to strengthen all-channel sales and operations and the gradual decrease in the percentage of Taobao series.

In terms of make-up, in September, due to the low base factor, Mao Geping GMV increased 45% year over year. Perfect Diary, Florasis, Timage and Little Ondine all declined significantly year over year.